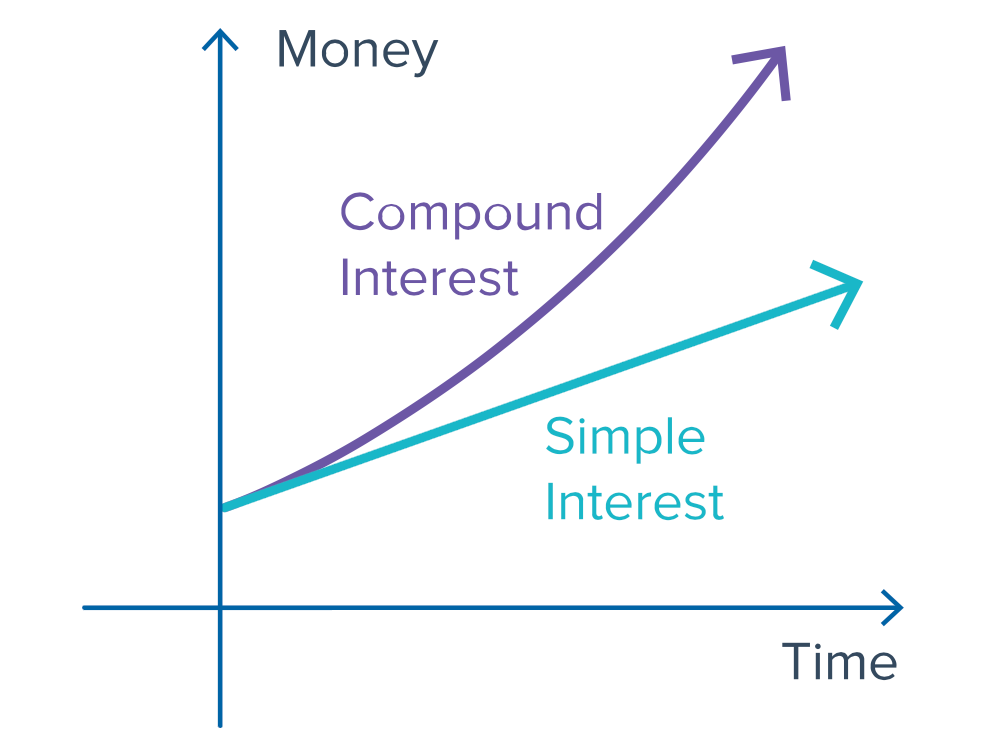

“Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn't … pays it.” Don't take my word for it, these are Albert Einstein's. With compound interest, returns earned on the investment are reinvested back into the investment, thereby generating additional returns over time – interest on interest. In other words, the interest that you earn on your initial investment is added to the principal amount, and the interest is then calculated on the new, larger amount. When you reinvest your earned interest in such a way, your original investment grows exponentially over time, rather than linearly.

Power of Time and Consistency

Over time, this compounding effect can lead to significant growth in your investment portfolio. The longer you hold your investment and the higher the interest rate, the greater the potential growth. The longer you leave your money invested, the more you allow the compound interest to work its magic. It's the principle of the earlier, the better. Start with what you can, no matter how small, and stick with it.

How to become a millionaire: pic.twitter.com/8f0lUh0fSG

— M O R E (@OwnFoundations) April 26, 2023

The Math Behind Compound Interest

Compound interest is the interest earned on both the principal amount and any accumulated interest from previous periods. Check this example to see how it is calculated. Suppose you invest $1,000 at an annual interest rate of 5%. After one year, your investment will have grown to: $1,000 x 1.05 = $1,050.

After the second year, your initial investment will be worth: $1,050 x 1.05 = $1,102.50.

After three years, your investment will have grown to: $1,102.50 x 1.05 = $1,157.63.

After year 10: $1,628,90. You get the math.

Compound Interest Opportunities

Investment opportunities that use compound interest include:

Dividend Reinvestment Plans (DRIPs): Some companies offer shareholders the option to reinvest dividends back into additional shares of stock through DRIPs. This is a form of compound interest because you're using your dividends to buy more shares, which can then generate even more dividends over time.

Bond Investing: When you invest in bonds, you're essentially lending money to an entity - a corporation or government - in exchange for periodic interest or coupon payments and the bond's initial value - the so-called face value - when the bond matures. The interest or coupons earned can be reinvested into additional fixed income securities, leveraging the power of compound interest.

ETFs: These investment vehicles pool money from many investors to purchase a diversified portfolio of stocks, bonds, or other assets. The returns from dividends or interest on the portfolio's holdings can be automatically reinvested, resulting in compounding growth.

Real estate: Rental properties or real estate investment trusts (REITs) can provide opportunities to earn compound interest, too.

When looking for compound interest opportunities, it's important to consider factors such as:

- potential returns

- risks and

- fees

Beating Inflation

Another benefit of compound interest is its power to counteract inflation. We all know that over time, money loses its value – that's inflation. However, when your money is earning compound interest, it's growing at a rate that should outpace inflation.

Closing Insights

The power of compound interest is a powerful tool for building wealth, but it's important to remember that it requires patience and a long-term investment horizon. Common mistakes that can hinder the compounding process are withdrawing money too early or not reinvesting dividends, coupons or rental payments. Compounding can happen at different intervals: daily, monthly, quarterly annually. The higher the frequency of compounding, the more you can grow. So, when comparing investment options, take note of their compounding intervals.

You should consider your investment goals and risk tolerance before making any investment decisions. Since every investor's situation is unique, and since what works for one person may not work for another, keep educating yourself to make informed decisions. Reach out for MORE at OwnFoundations if you're not sure how to get started and keep in mind:

- Patience

- Start early

- Consistency is key

- Reinvest your earnings

Remember, every financial journey starts with a single step, and understanding compound interest is a very crucial first step. Start today, stick with it, and watch the magic unfold. Until next time, keep investing and keep growing!