In a world where central banks can endlessly print money, Bitcoin stands apart with a revolutionary concept: there will never be more than 21 million bitcoins. While central banks and governments worldwide created trillions in new currency during recent crises, Bitcoin's supply remained fixed and predictable, creating what Michael Saylor calls "the most difficult property the human race possesses to confiscate."

This isn't just a technical footnote—it's a fundamental principle reshaping how we build and preserve wealth in the digital age. Bitcoin's hard cap represents a fundamental rethinking of how wealth is preserved in the digital age—potentially the most significant financial innovation since the invention of banking itself.

1. The Power of Digital Scarcity

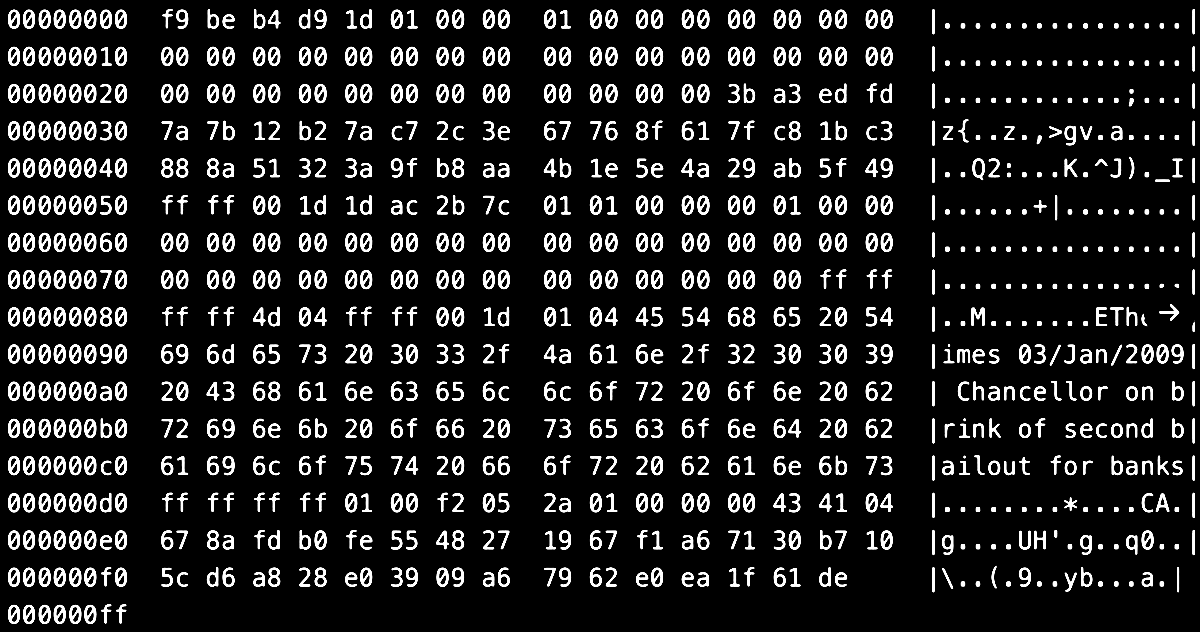

When Satoshi Nakamoto mined the Bitcoin Genesis Block on January 3, 2009, the code contained something unprecedented: true digital scarcity. Unlike dollars, euros, yen or any traditional currency, Bitcoin has a predetermined, unchangeable total supply that cannot be changed.

Think about what scarcity does in other contexts. Fine art, precious metals, beachfront property—their limited availability contributes significantly to their value.

Scarcity Creates Value

Bitcoin brings this same principle to the digital realm. The 21 million coin limit mimics the scarcity of precious metals like physical gold, which is why many refer to Bitcoin as, digital gold. It means no government or central bank can dilute its value by creating more coins arbitrarily. This embedded scarcity creates a natural economic incentive for long-term value appreciation. Make sure to watch the short clip below to see how other assets in comparison to Bitcoin perform over time.

Bitcoin as a Store of Value (Sources: see above)

2. The Inflation Trap Most Don't See Coming

Most of us have felt the effects of inflation in recent years. Groceries cost more. Housing prices (measured in fiat currency) climb. The money in our savings accounts buys less than it once did. What's often misunderstood is that inflation isn't just a temporary economic disruption—it's a deliberate and permanent design element of our modern monetary system.

In recent years, governments and central banks have been printing more money to stimulate the economy and have dramatically increased the money supply at will. When they expand the money supply, they're essentially diluting the value of existing money.

Bitcoin's approach is fundamentally different. Its fixed supply ensures that, unlike traditional currencies, it cannot be diluted and hence is a hedge against inflation. While traditional assets may struggle in inflationary environments, Bitcoin's fundamental scarcity becomes increasingly valuable—explaining its exponential growth trajectory despite volatility along the way.

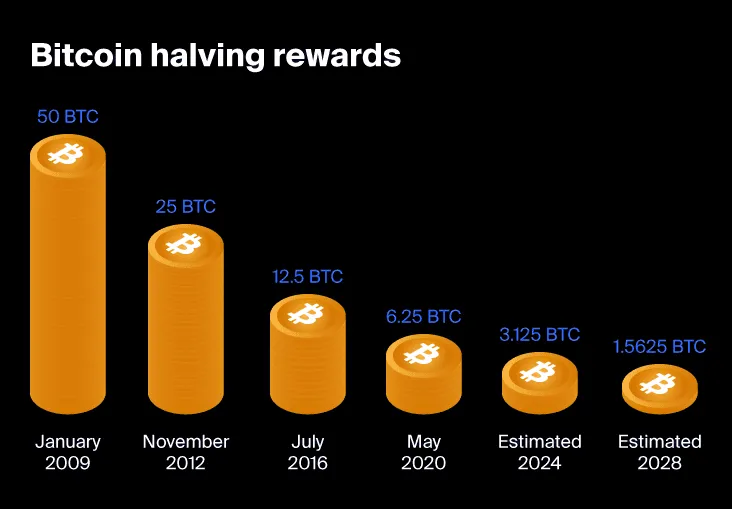

3. Understanding the "Halving" Mechanism

Before we jump into the Halving Mechanism, let's remember, that though Bitcoin has a fixed maximum supply (of 21 million bitcoins), not all of them are in circulation yet. New bitcoins enter the system through a process called mining. As of early 2025, about 19.6 million bitcoins have been mined, leaving roughly 1.4 million yet to be created.

Bitcoin's protocol includes a gradual reduction in new coin creation, known as "Halving." They occur approximately every four years, cutting the rate of new Bitcoin mining in half – hence the name. The final Bitcoin is projected to be mined around the year 2140.

Think of it like this: Imagine you're digging for gold, and every four years, the amount of gold you find in each successful dig gets cut in half. At the same time, the ground generally gets harder to dig through as more people bring better shovels. The result is that each new piece of gold requires more effort and resources to unearth.

This is why bitcoin becomes harder to create over time – you need to do more work for a smaller reward, making each new bitcoin increasingly costly to mine. The increasing cost of production for Bitcoin supports the scarcity narrative in several ways:

- It prevents sudden flooding of the market with new coins

- It ensures new supply comes into the market at a predictable, diminishing rate

Why This Matters for Long-Term Wealth Building

For those looking to preserve and grow wealth over decades, Bitcoin's limited supply offers several compelling advantages:

- Hedge against monetary debasement: (Fancy way to say, protection against inflation.) As governments continue to massively increase money supply, assets with fixed quantities become more attractive as a store of value.

- Predictable supply schedule: Unlike gold or other commodities where new discoveries can increase supply unexpectedly, Bitcoin's supply is mathematically predictable.

- Increasing scarcity: Not only is Bitcoin's supply capped, but an estimated 3-4 million bitcoins have been permanently lost already due to forgotten passwords and lost private keys(!), making the actual circulating supply even lower.

- Global accessibility: Anyone with internet access can own Bitcoin without needing permission from financial institutions or governments.

Building a Bitcoin Strategy

If you're considering Bitcoin as part of a long-term wealth strategy, stay tuned for our upcoming blog. We will introduce a step-by-step approach that covers how to:

- Start small

- Dollar-cost averaging

- Long-term thinking

- Self custody

The Bigger Picture

Beyond personal wealth building, Bitcoin's limited supply raises important questions about money itself. Throughout history, virtually all currencies have eventually been devalued through inflation. Bitcoin proposes a different model—one where money's supply is transparent, predictable, and ultimately fixed. Increasingly, forward-thinking individuals, corporations, and even nations are recognizing Bitcoin's potential as a monetary revolution. Its unique approach to scarcity has already challenged conventional thinking about money and value. What's clear is that its limited supply offers a compelling alternative to our current monetary paradigm.

As with any investment, understanding the fundamentals is crucial. Bitcoin's supply cap of 21 million isn't just a technical specification—it's the foundation of true ownership and financial sovereignty.

*Not Financial Advice, always DYOR (Do Your Own Research).